MENUMENU

Get a quote (020) 7937 2109

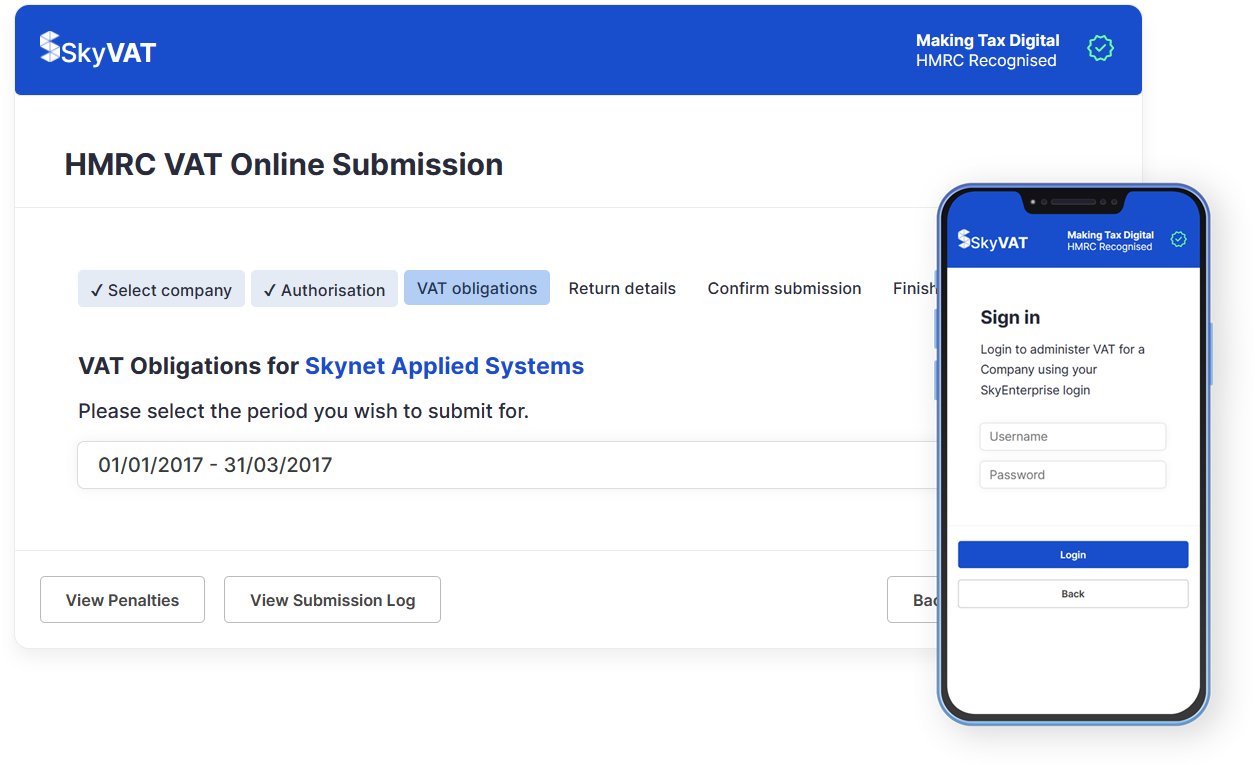

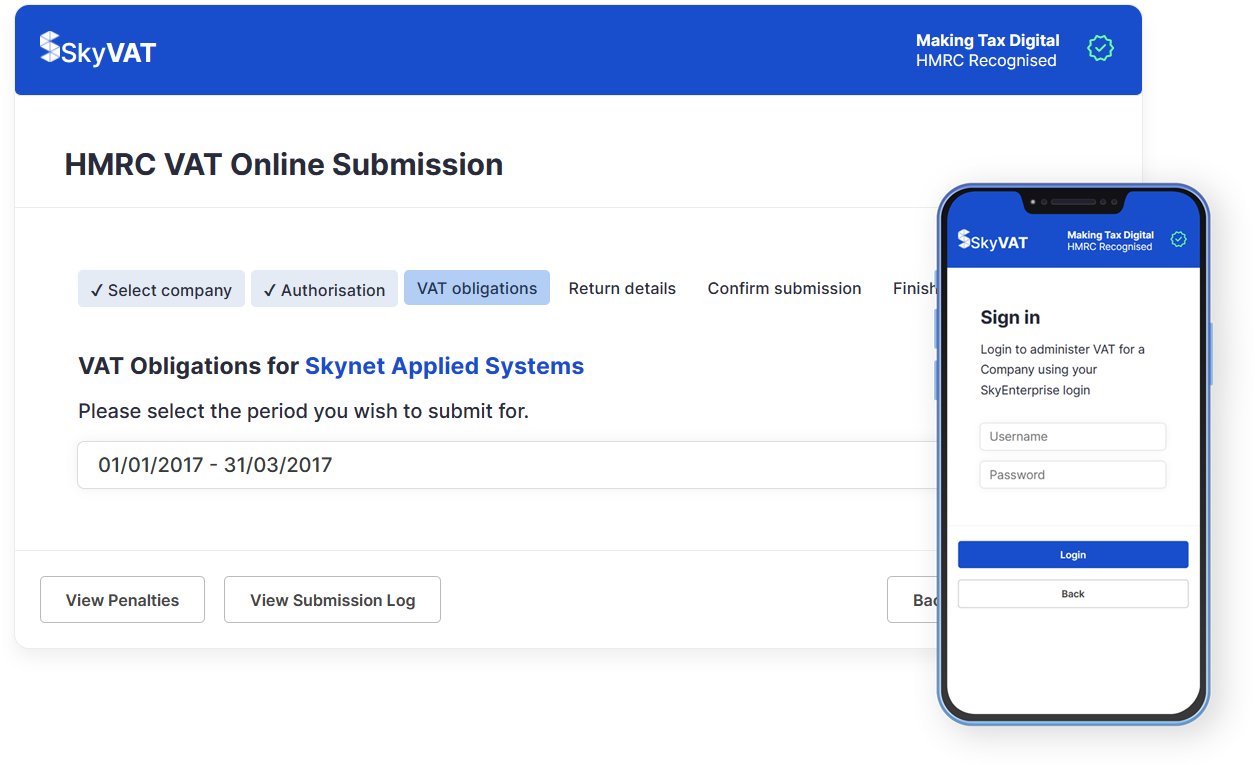

Our accounting software works directly with SkyVAT and HMRC to ensure your VAT submissions are always correct.

Access your VAT returns online, anytime, anywhere with our cloud and server based web application software. Submit your VAT return from any device or location on the web.

Our cross-company VAT return feature allows you to process, submit and view previous returns for multiple companies with the simple option to choose company at the start of your return process.

Whether you use accrual or cash based accounting, SkyVAT allows you to submit VAT to HMRC either way.

With our SkyVAT software, you will be able to keep track of all of your companies' VAT returns.

View all VAT returns by choosing the return date periods. View due, late and future obligations and due and paid payments made to HMRC.

Assign the right people to submit VAT returns for your company. Assign single or multiple users to one or more companies for VAT submissions.

Produce custom reports for all of your transactions, including authorised and pending items. Filter reports to show figures you want to see. Produce the VAT 100 report showing the 9 boxes for VAT returns.

If you are a UK VAT registered business with a taxable turnover above the VAT threshold (currently £85,000) then you are required to keep your records digital and provide VAT return information to HMRC (HM Revenue and Customs) using MTD VAT compatible software.

Our SkyVAT MTD software comes as part of the package for all of our clients registered for VAT.

We are ready to answer any questions you might have, and provide you with advice on choosing the best payroll solution for you.