Help HR stay compliant with Payroll software made for UK regulations while maintaining clear, reliable payroll records even as rules change.

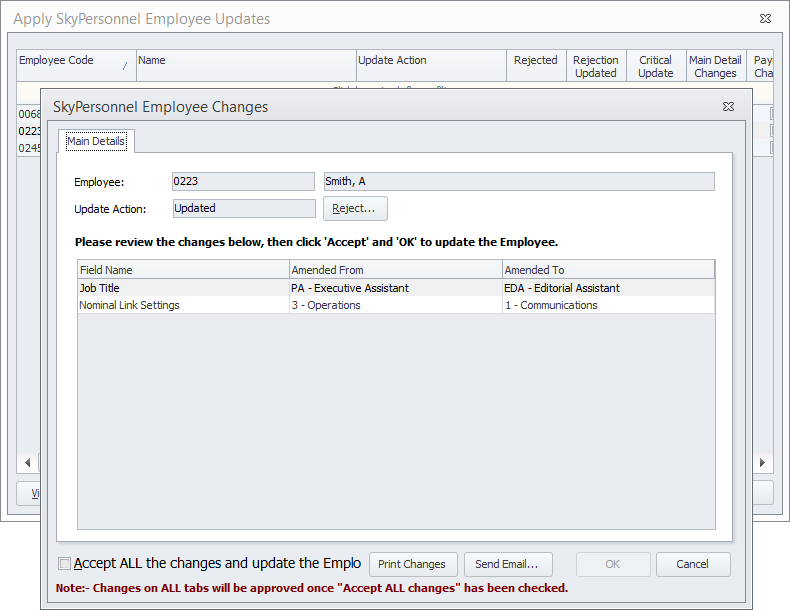

With streamlined workflows and quick processing payroll software supports HR manage complexity without increasing manual effort or headcount.

Automate manual tasks so HR teams spend less time running payroll and more time focused on talent and supporting employees.

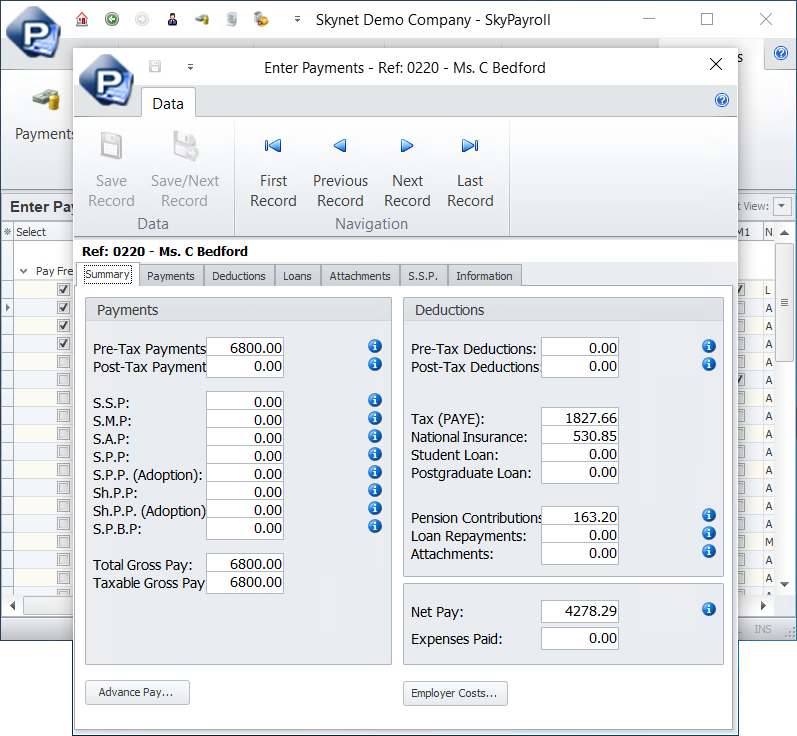

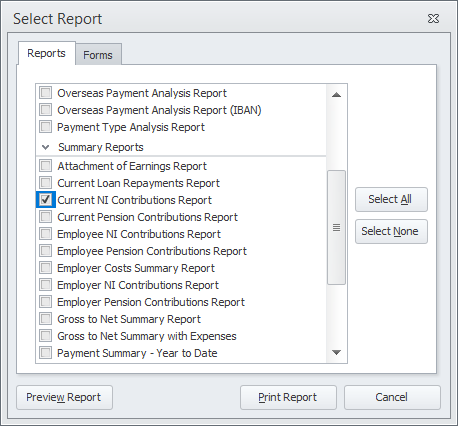

Run standard and custom reports covering pay, deductions, tax, NI, pensions, headcount, and payroll costs, supporting everything from routine checks to strategic planning and audits.

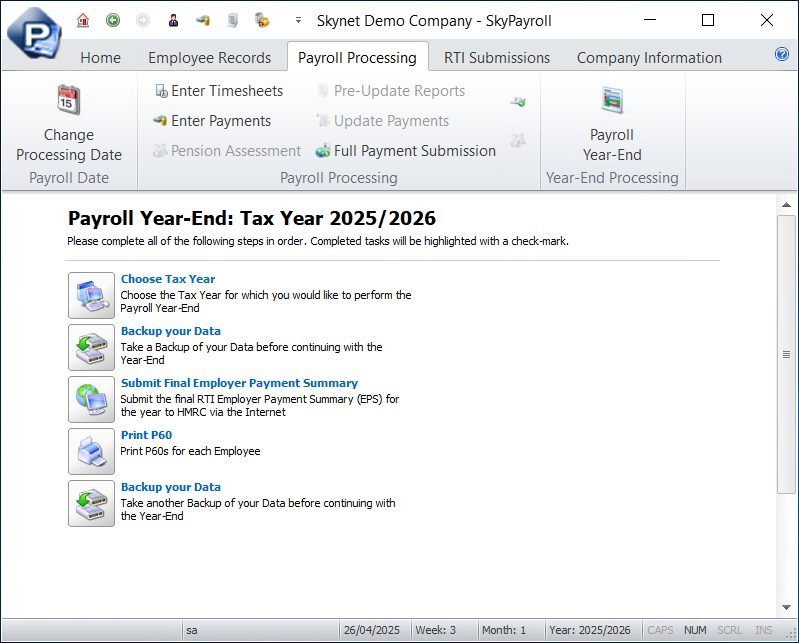

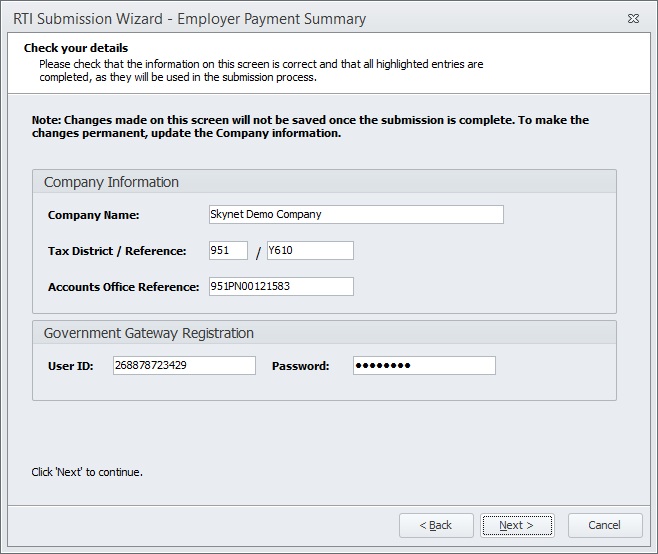

Payroll software automates employee pay, tax, National Insurance, pensions and statutory reporting. Skynet Applied Systems’ payroll software helps businesses run accurate, HMRC-compliant payroll and submit RTI directly to HMRC.

If you employ staff, our software saves time, reduces errors and helps you stay compliant with HMRC requirements. It’s useful for businesses of all sizes, even with just a few employees.

Key features include automatic payroll calculations, HMRC compliance, payslips and reports, pension handling, employee self-service, secure access, and integration with HR or finance systems.

Skynet payroll software is HMRC-recognised, reliable, scalable and integrates with wider business systems. It offers automation, flexibility and UK-based support from an experienced software provider.